Coke vs. Gold Update

9/10/20

In my article from 8/16/16 Coke vs. Gold, I decided to compare Coke stock (KO) to 1g of gold since they were close in value, $43.91 (paying a dividend of $1.40/share/year) and $43.04 respectively. I reasoned or speculated that the stock KO will beat 1g of gold moving forward in terms of overall investment, and said I'd check in on them every year.

I checked in in 2017 with an update, and continued for 2018 and 2019.

The time has come again to do the checking for 2020.

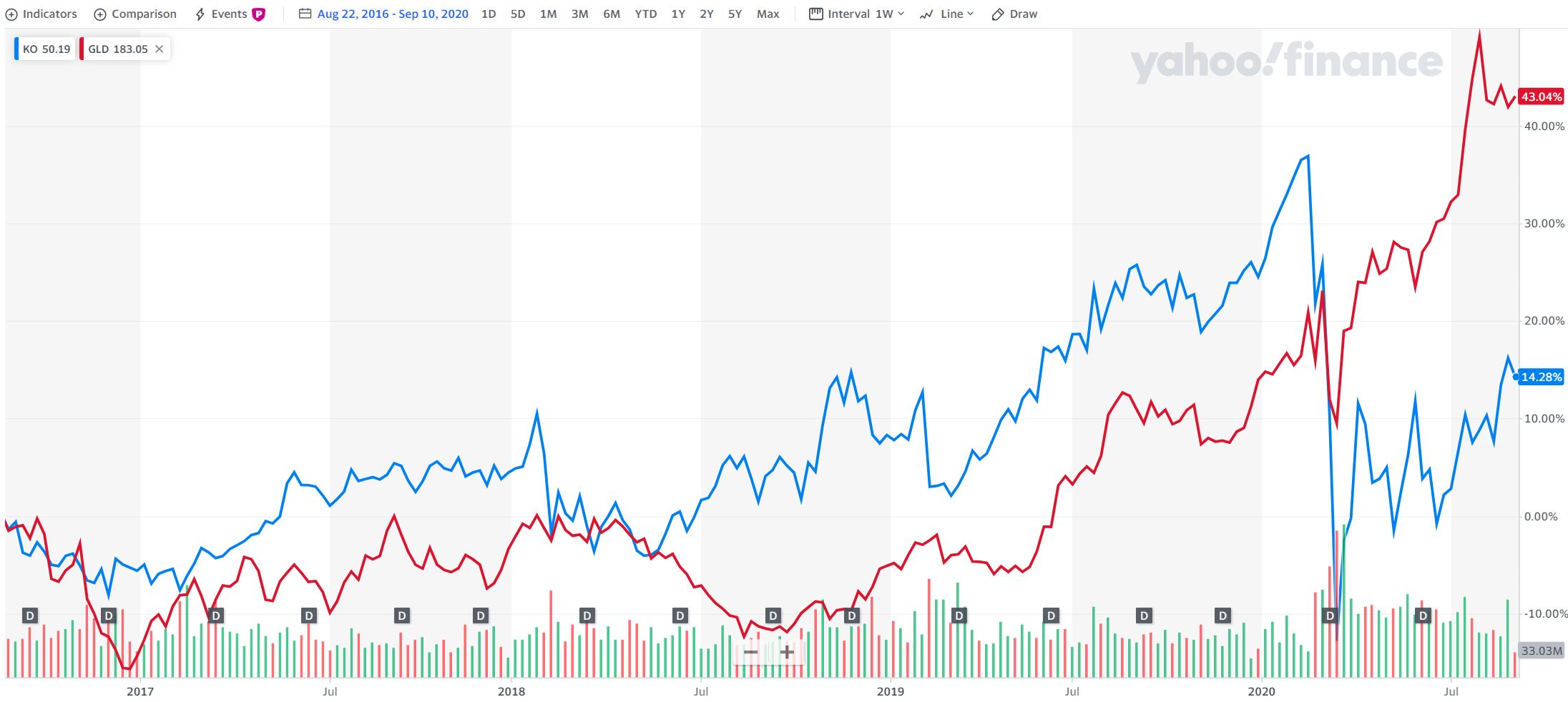

Here is a graph of the performance of KO and GLD since 8/16/16

As we can see from the graph, KO is +14.28% and gold is +43.04% over this time period. Additionaly, KO's dividend has increased 17.14% from 2016 to 2020.

To summarize, if we started 8/16/16 with 1 share of KO, and 1g of gold, we'd have:

- 2016, KO = $43.91, $1.40/yr, 1g gold = $43.04

- 2017, KO = $46.20, $1.48/yr, 1g gold = $41.45

- 2018, KO = $46.08, $1.56/yr, 1g gold = $37.78

- 2019, KO = $53.74, $1.60/yr, 1g gold = $49.17

- 2020, KO = $50.19, $1.64/yr, 1g gold = $64.29

I believe the price of gold increased, and stocks generally decreased, because of COVID related concerns in 2020 Q1, and not based on any fundamentals. But, let's check back in on how they are doing 8/16/21 (and every year anniversary after).

Thanks for reading.

Please anonymously VOTE on the content you have just read:

Like:Dislike: