Receiving Investment Income Everyday, Part 4

1/16/17

In my original Receiving Investment Income Everyday article, I tallied the days of the year that I received dividend or interest payments from stocks, Treasuries, and peer to peer notes for the year 2013. I did this because while some concentrate on total yearly or monthly income, I wanted to concentrate on daily income. It is one of my investing goals to get paid from a variety of reliable sources literally everyday, or as close to that as possible.

I just completed tallying the numbers for the year 2016, and I present them in this article for your reading pleasure.

In 2016 I received 853 dividend payments from monthly, quarterly, biannual, and yearly dividend payers that I own. I purchased several dividend paying companies over the year, and the dividend paying companies I already had, in general, continued paying dividends, with a few notable exceptions.

Currently, about 26.90% of my stocks are monthly dividend payers, 57.93% quarterly dividend payers, 2.76% biannual dividend payers, 2.76% yearly dividend payers, and the remaining 9.66% do not pay any dividends. I like the theory of monthly dividends for faster compounding and planning, but with a few exceptions, the "talent pool" of the monthly payers is much less than that of the quarterly (and other frequency) dividend payers. Remember, never buy a stock just because it pays monthly.

Of course, these received dividend payments did not all fall on different days; there was a lot of overlap in the payment dates. I omit the table here, but there are 199 days total where I received at least one dividend from stocks.

However, this is just dividend payments from stocks. What about my payments from other investments, such as interest payments from P2P notes and interest payments from Treasuries? How much more would these payments "fill in" things?

By 2016, I had already re-accumulated a number of P2P notes, having liquidated much of my P2P notes in 2014. Adding in payments from these P2P notes, as well as from Treasuries (I have Bills, FRNs, Notes, Bonds, and TIPS of all types of maturities), we get 257 days.

Although I have been buying and holding EE and I savings bonds since 2012, this analysis for 2016 is the first time I have included them in the analysis. Each savings bond pays on the first of the month. Adding these into the analysis, we get 258 days. We can see that while savings bonds added a lot more payments, there is a ton of overlap in the payment dates so they only added 1 day where there wasn't a payment already. In other words, adding savings bonds took us from 257 to 258 days even though it increased the total number of payments by 3,439 payments.

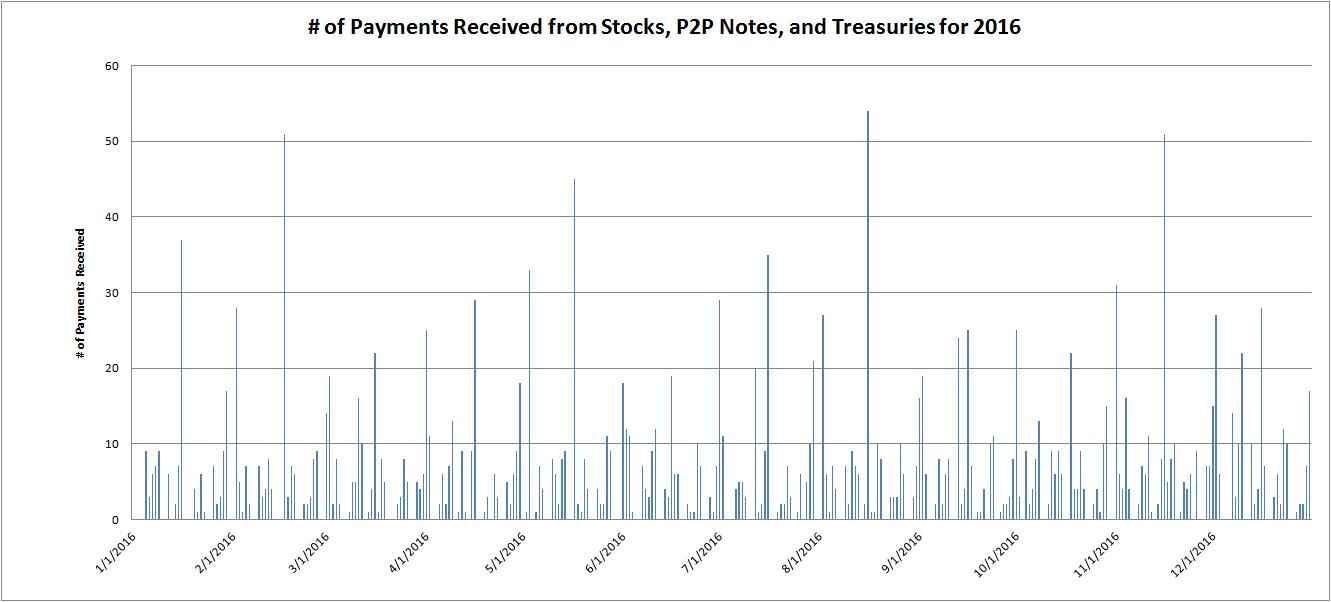

Graphically, the counts of the payments received from stocks, P2P notes, and Treasuries (except savings bonds) for 2016 looks like:

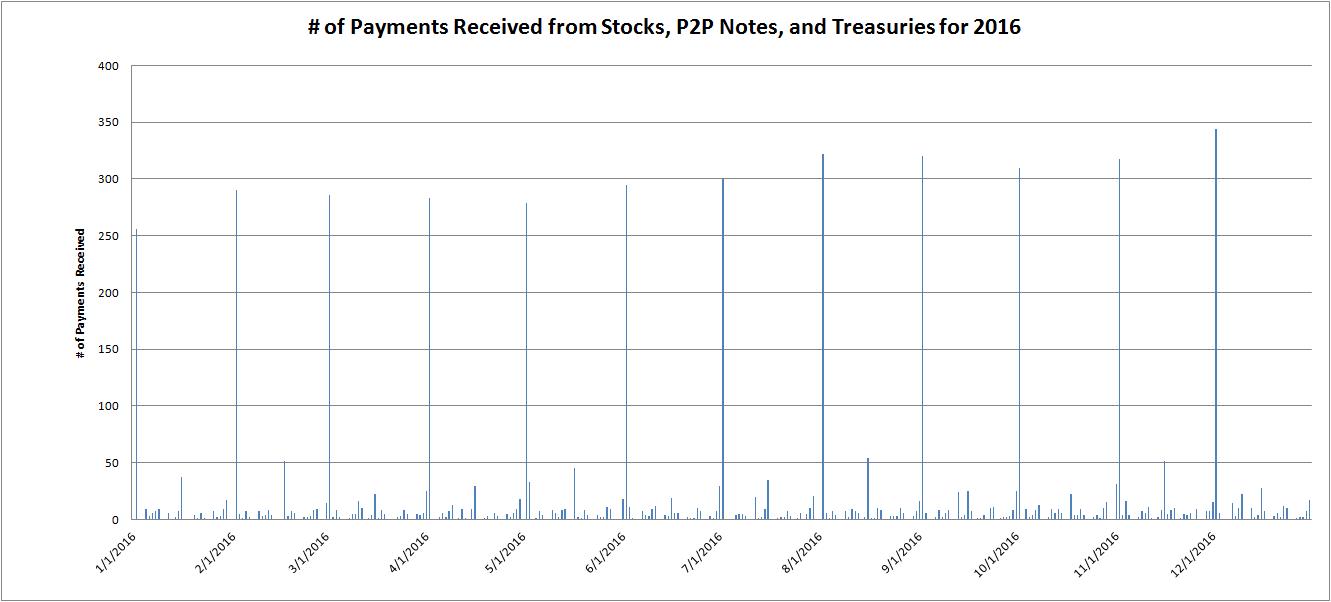

If we now include the savings bonds in the analysis, the counts of payments received for 2016 looks like:

One can clearly see the monthly and quarterly spikes of payment counts.

Note that for 2013, my % of the days in a year which I was receiving income from investments was 184/365 or ~50%. For 2014, this ratio was actually 289/365 ~ 79.18%. For 2015, this ratio was 229/365 ~ 62.74%. And as mentioned, for 2016 this ratio is 258/365 = 70.68%.

You might be wondering about the distribution of payments from stocks, P2P notes, and Treasuries. The distributions of the number of payments and the payment amounts is below:

Investment Type |

% of Number of Payments |

% of Total Payment $ |

Stocks |

15.49% |

67.23% |

P2P Notes |

12.93% |

22.37% |

Treasuries |

71.58% |

10.40% |

For 2017, I hope to buy more dividend paying stocks, mostly quarterly, as well as to continue to increase the number of P2P notes and Treasuries. I also expect to see the Federal Funds rate increase some more as well, which will probably remove the "threat" of not receiving interest from short term Treasury bills due to very small interest rates (ie. the situation where one pays $100 only to get $100 back 28 days later).

Please anonymously VOTE on the content you have just read:

Like:Dislike: