Receiving Investment Income Everyday, Part 2

1/13/15

In my Receiving Investment Income Everyday article, I tallied the days of the year that I received dividend or interest payments from stocks, Treasuries, and peer to peer notes for the year 2013. I did this because while some concentrate on total yearly or monthly income, I wanted to concentrate on daily income.

I just completed tallying the numbers for 2014, and I present them in this article.

In 2014 I received 639 dividend payments from monthly, quarterly, biannual, and yearly dividend payers that I own. This number of payments is up 69% from 2013. The reason for this is because I purchased many dividend paying companies over the year.

Currently, about 40.52% of my stocks are monthly dividend payers, 44.83% quarterly dividend payers, 1.72% biannual dividend payers, 3.45% yearly dividend payers, and the remaining 9.48% do not pay any dividends.

Of course, these received dividend payments did not all fall on different days; there was a lot of overlap. I omit the table here, but it makes 178 days total where I received at least one dividend.

However, this is just dividend income from stocks. What about my other payments, such as interest from P2P notes and interest payments from Treasuries? How much more would these payments "fill in" the table?

In 2014, I had several hundred P2P notes, of 3 and 5 year durations, and all ratings but mostly A and AA. Adding in payments from these, as well as from Treasuries (I have a few Bills, and about a dozen each of FRNs, Notes, Bonds, and TIPS of all types of maturities), we get 289 days.

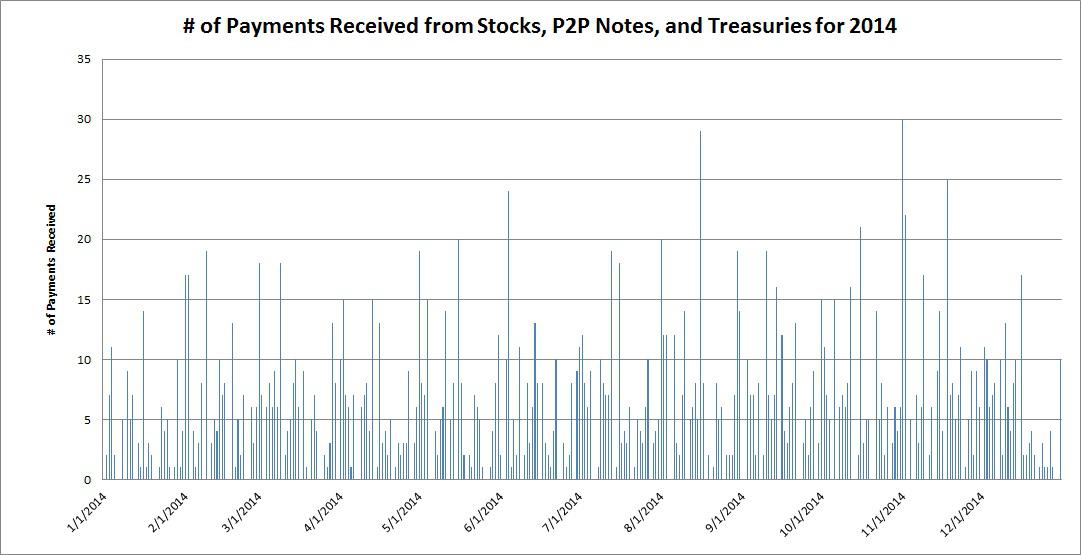

Graphically, the counts of the payments received from stocks, P2P notes, and Treasuries for 2014 looks like:

For 2013, my % of the days in a year which I was receiving income from investments was 184/365 or ~50%. My goal for 2014 was 75%. For 2014, this is ratio was actually 289/365 ~ 79.18%, so I chalk this up as a success. I also see that the payment graph "smoothed out" somewhat, and payments were received for all days of the week, not just the weekdays.

Some changes to see for 2015, are that I liquidated my positions in peer to peer notes (and used the proceeds to buy dividend paying stocks and interest paying Treasuries) perceiving them as too risky for my tastes, after experiencing a few defaults. I expect this to decrease the counts quite a bit. I also believe that with interest rates most likely increasing, I should see more payments coming from my Treasury Bills, since now with rates so low, the 28-day Treasury Bills often pay $0, since the purchase price of $100 is the same as what gets returned to me after 28 days. With all of that said, my goal is to get the percent to 85% for 2015.

Please anonymously VOTE on the content you have just read:

Like:Dislike: