Dollar Index Basics

6/28/17

Frankly speaking, most people have absolutely no clue what a "dollar index" is. Additionally, Federal Reserve conspiracy theorists, extreme goldbugs, and anti-government types on the Internet love to distort and outright lie on what the dollar index is or what the movements in the dollar index chart mean to push their strange agendas for profit, confusing newbies even further. This article hopes to explain the basics of what the dollar index is.

First, open up this paper "Indexes of the Foreign Exchange Value of the Dollar" and print it out for later reading. Consider it the official explanation of a dollar index. Most people, unfortunately, won't take the time to read or understand it.

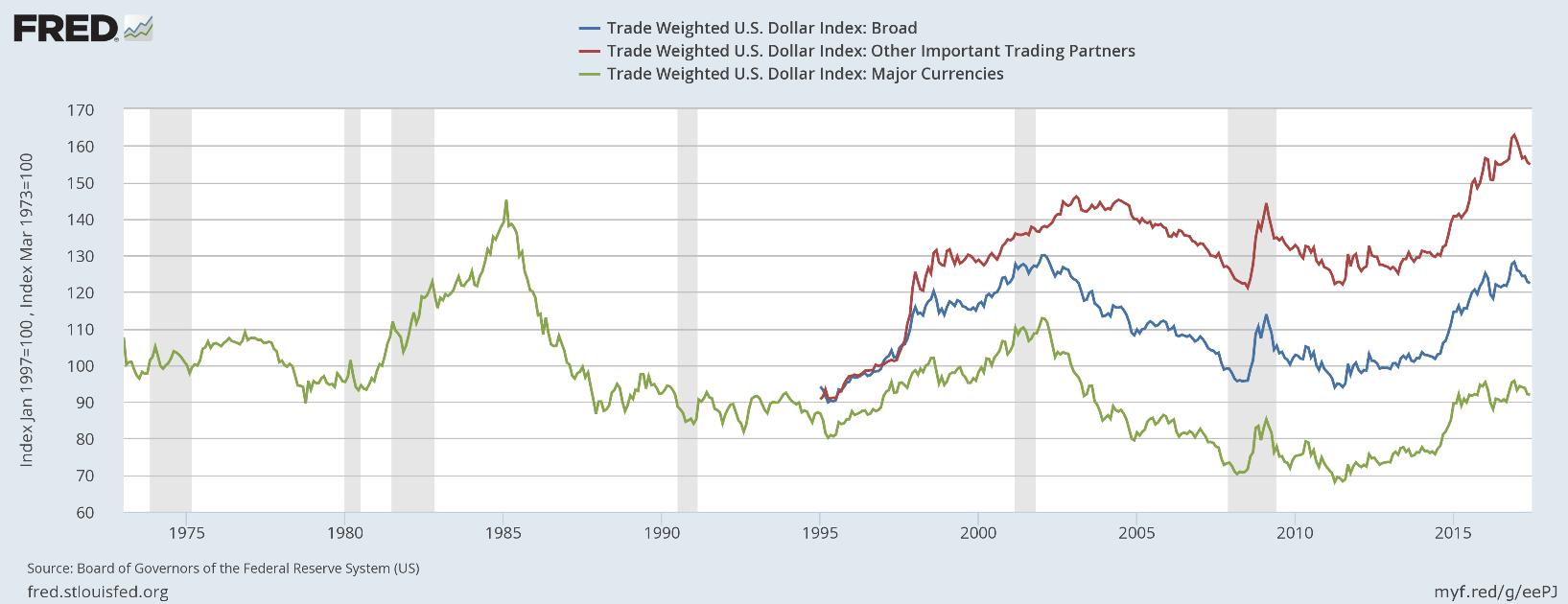

Second, here is a graph that I created on 6/28/17:

What this graph shows is the publically available historical data of some dollar indices. That's right, I said "indices", not "index", as there are at least three main dollar indices that I am aware of. Typically "the dollar index" will be talked about as if there is only one. However, they are quite different.

Here is a description of the three indices:

-

Trade Weighted U.S. Dollar Index: Other Important Trading Partners:

This is also referred to as "OITP". It is a weighted average of the foreign exchange value of the U.S. dollar against a subset of the broad index currencies that do not circulate widely outside the country of issue. Countries whose currencies are included in the other important trading partners index are Mexico, China, Taiwan, Korea, Singapore, Hong Kong, Malaysia, Brazil, Thailand, Philippines, Indonesia, India, Israel, Saudi Arabia, Russia, Argentina, Venezuela, Chile and Colombia.

-

Trade Weighted U.S. Dollar Index: Broad:

A weighted average of the foreign exchange value of the U.S. dollar against the currencies of a broad group of major U.S. trading partners. Broad currency index includes the Euro Area, Canada, Japan, Mexico, China, United Kingdom, Taiwan, Korea, Singapore, Hong Kong, Malaysia, Brazil, Switzerland, Thailand, Philippines, Australia, Indonesia, India, Israel, Saudi Arabia, Russia, Sweden, Argentina, Venezuela, Chile and Colombia.

-

Trade Weighted U.S. Dollar Index: Major Currencies:

A weighted average of the foreign exchange value of the U.S. dollar against a subset of the broad index currencies that circulate widely outside the country of issue. Major currencies index includes the Euro Area, Canada, Japan, United Kingdom, Switzerland, Australia, and Sweden.

For the real definitions, see the paper I referenced. I will give my wrong but intuitive versions, my conceptions of them, below.

The "major currencies" one, I think of as the United States dollar "vs" our toughest competition (speaking currency-wise). The "other important trading partners" one I think of as the United States dollar "vs" tough but not as tough currencies. Last, the "broad" one I think of as an average of the "major currencies" and "other important trading partners" lines, or as the United States dollar "vs" all currencies. Note that I put the "vs" in quotes. These are friendly, for the most part, trading partners we are talking about.

For the mathematics, I will just refer you to the paper. The mathematics is not difficult, essentially just a geometric average of exchange rates that are weighted by the "importance" of a currency, but there certainly are a lot of details that go into it, so I will omit it here.

Does a dollar index moving down mean "bad" or "the dollar is crashing" or "the U.S. economy will implode" or whatever the internet quacks want to convince you of? Nope. Movement in a dollar index simply reflects patterns in international trade among tough competition. It is a relative measure, not absolute. I think of it as "measuring pressure". In my opinion, there are so many macroeconomic factors that go into a dollar index measure that using day to day movements of a dollar index to determine a personal investing strategy is somewhat silly.

Please read the paper. Thank you.

Please anonymously VOTE on the content you have just read:

Like:Dislike: