Spot Price Premium

3/17/20

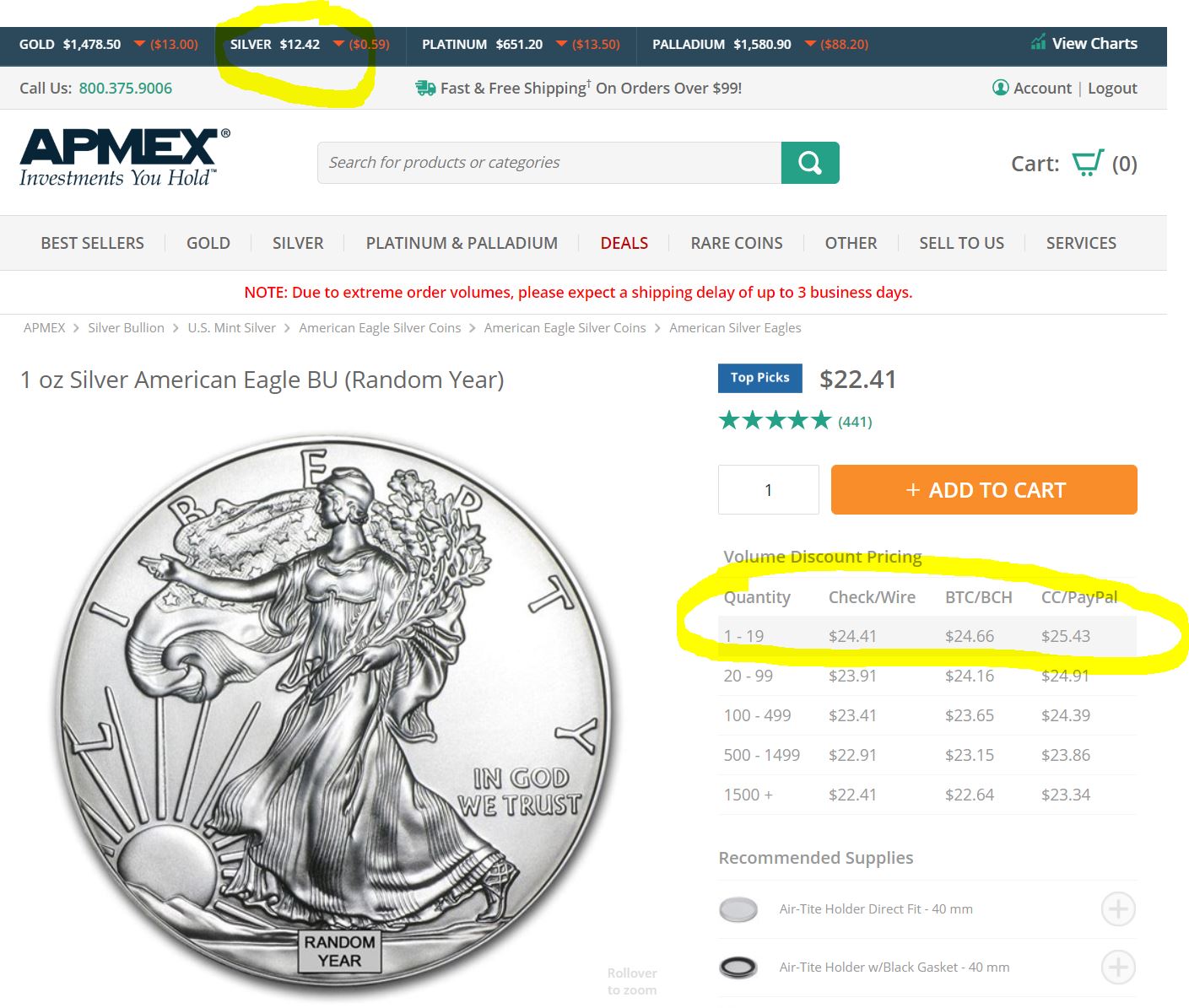

Here is a great example of why, if you buy silver or gold, you do not get even close to the spot price at times. Simply put, the dealers just increase the premiums to make up for a drop in spot price. Consider the silver price and the prices to buy an American Silver Eagle on 3/16/20 at APMEX

This is all understandable, and expected, however, because even a large precious metals dealer, and their staff, have a "survival constraint", and there are always larger premiums on American Silver Eagles compared to generic silver rounds. What is not great, however, is when the premium is so large that it starts to enter price gouging territory. Not to mention, a "Sell to Us" price would be much closer to the spot price. Also during this time, order minimums will also increase, from $0 to say $299.

Thanks for reading.

Please anonymously VOTE on the content you have just read:

Like:Dislike: