Rising Interest Rates Can Be Good For Bond Investors

9/22/16

You'll often hear, either by newbie investors or by conspiracy theorists, that rising rates are bad for bond investors. This is most likely not true.

First, it is true that there is an inverse relation between say Treasury yields and price. That is, when one goes up, the other goes down, and vice-versa. Therefore, the newbie investor says, if rates rise then price goes down and that's bad! This is a typical newbie mistake. For a bond that is certainly true, but only maybe bad if you say have to sell the bond because of hardship. If you don't sell, your self-liquidating bonds (as all are) would simply return the face value to you at maturity, despite the crazy market movements that may have taken place during the time you bought it to the time it matures.

Second, experiencing hardship and having to sell at a loss can happen with any investment, not just bonds. The goldbug does not like the fact that physical gold does not pay them interest along the way, since if you have to sell at a hardship, at least the interest payments can cushion the pain somewhat. As far as the rebuttal "ZIRP" for bonds, technically physical gold is actually the one paying literally 0% interest always.

Third, most bond investors do not ever just buy a single bond, but rather have a very freakin' deep bond ladder. A bond ladder is, say you've been buying bonds for 20 years up until the present day. You'd have interest payments coming in at all times, as well as maturing bonds returning their principal to you at various times. If rates are rising now, your interest as well as returned principal can be invested at these higher rates, thus returning more income to you.

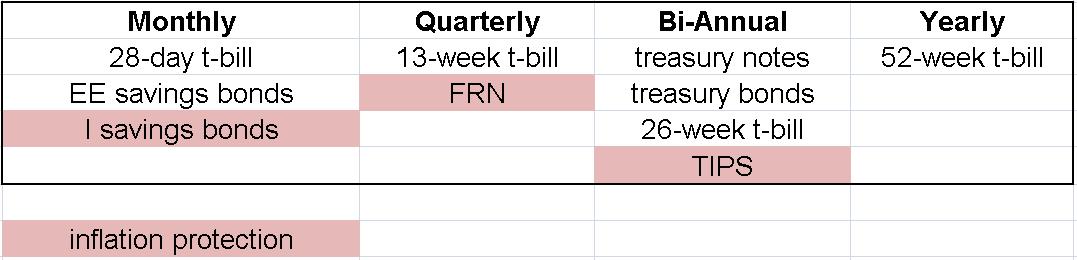

See the following table below:

This is a table of the types of U.S. Treasuries and the frequency they pay. I also identified the Treasuries in pink that have either explicit inflation adjustment (according to CPI), or some rate update, in the case of the Floating Rate Notes (FRN).

Please anonymously VOTE on the content you have just read:

Like:Dislike: